Benchmarking the Fed’s Dual-Mandate Performance

August 2, 2012 11:39 am (EST)

- Post

- Blog posts represent the views of CFR fellows and staff and not those of CFR, which takes no institutional positions.

More on:

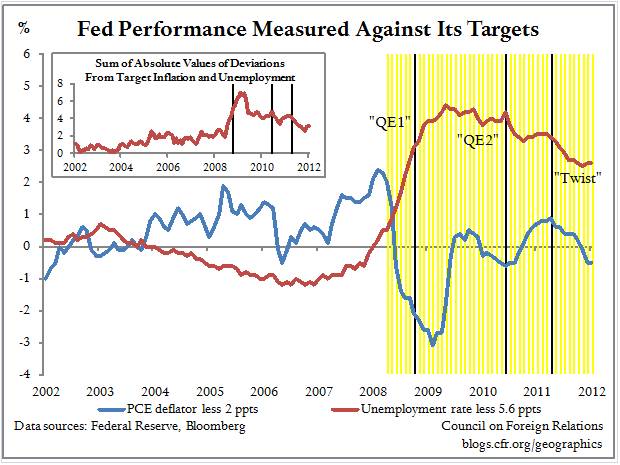

The Fed has a dual mandate to pursue price stability and maximum employment. How should these be defined? In January, the Fed set itself a long-run inflation target of 2%, while in June the midpoint of Fed board members’ and Reserve Bank presidents’ long-run unemployment predictions was 5.6%. Our figure above shows actual inflation and unemployment performance relative to these targets going back to 2002. What stands out is the divergence that opens up, particularly on the unemployment front, after Lehman Brothers failed in September 2008. The sum of the deviations reached its peak in July 2009, as shown in the small box in the upper left of the figure. Though it has since declined fairly steadily, it is still well above zero – zero being a benchmark for fulfilling the combined mandate. This suggests that the Fed’s doves should continue to hold the upper hand.

Federal Reserve: Objectives in Conducting Monetary Policy

Federal Reserve: Longer-Run Goals and Policy Strategy

Hilsenrath: Gauging the Triggers to Fed Action

Mallaby: Show Some Real Audacity at the Fed

More on:

Online Store

Online Store